- Looking for working capital to help grow your business?

- Need some money to get you through tough times?

- Is the bank not giving you a loan due to bad credit scores?

- Does your business accept credit or debit cards for payments?

We can probably help you!

Business Cash Advance

How can a Business Cash Advance help your business?

If you are a Canadian business owner in need of funds to sustain or expand your business, we are here for you!

We are a Canadian owned business backed by substantial assets, offering an alternative to a traditional business bank loan. With our easy business cash advance program, you have access to the funds you need to continue to take advantage of new business opportunities – without the hassle of a fixed repayment plan to stress you out.

Instead of a traditional bank loan, our business cash advance will give you up to $200,000 that can be repaid as you earn it through future credit and debit card sales. The repayment is automatic, so you never have to worry about remembering to make a payment. All the work is done for you!

How is a business cash advance different from a bank loan?

- A traditional bank loan requires much more time and effort to acquire.

- A bank will conduct an in-depth credit check and ask for collateral to secure the business loan you need.

- You will fill out countless documents and then wait and wait for an answer on an approval.

- The approval process can be very humiliating because in most cases, if you are a new business owner or if your credit is not perfect, your bank loan will be denied.

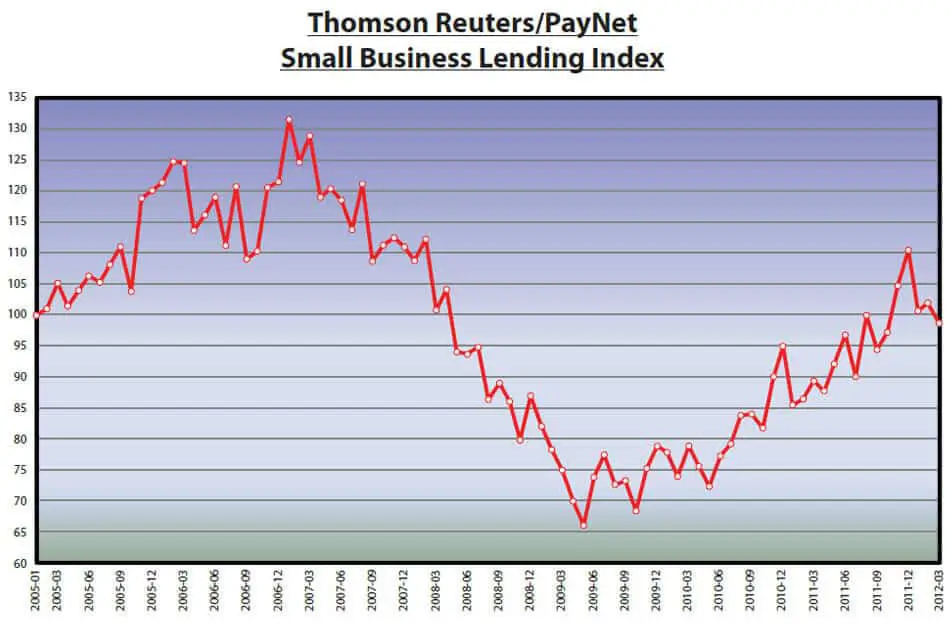

PayNet Study Shows Small Business Lending Fell in April

Banks are closing their doors to small business owners as they become more and more concerned about the economy. A recent study from ThomsonReuters and PayNet confirmed that lending had fallen 2 per cent in April after already falling 3 per cent in March. This is not...

Finding Restaurant Financing and Capital in Canada

Restaurant Financing and Capital No restaurants are ever able to fully operate without the right amount of financing. Getting restaurant financing and capital can be done through a number of different processes. Each of these options can be used to help get any type...

Options For Medical Office Building Loans in Canada

If you're a doctor, you may be considering a medical office building loan. However, most doctors are surprised not only by how arduous the loan process is, but the length of time required for the loan to close. There are also many forces that can affect a doctor's...

Also check out our guides for Government grants and loans broken down by province:

Ontario | Quebec | British Columbia | Alberta

Are you currently accepting payments using credit or debit cards at your business? If so, we can probably help you find the money you need fast. Apply Now!