- Looking for working capital to help grow your business?

- Need some money to get you through tough times?

- Is the bank not giving you a loan due to bad credit scores?

- Does your business accept credit or debit cards for payments?

We can probably help you!

What is Working Capital Financing?

Working Capital Financing

As a business owner, you know that working capital financing is essential to your growing company. Working capital financing gives you the funds that you need for your business expenses, such as building or opening a new office, purchasing new business equipment, or even expanding your business into a franchise. Whatever your needs are, working capital financing can help your business take advantage of growth opportunities and stay competitive in the market.

If you have been unable to get the funding you need through a bank loan, you can still obtain the working capital financing you need to grow your business. With our merchant cash advance program, you can get up to $150,000 right away.

How to Obtain Working Capital Financing Through A Merchant Cash Advance

It is very easy for you to obtain the working capital you need for your business. Just take the first step by filling out the online application form. There is no credit check, no fixed repayment terms, and no set timeframe on when you have to pay the money back. Also, there are no hidden fees! There are no costs to apply for the working capital financing you need to keep your business going.

There are only a few requirements. Your business must accept Visa or MasterCard as a form of payment. The merchant cash advance works by purchasing a portion of your future credit card sales at a discounted rate, and your obligation is repaid as your business earns it.

No Restrictions on How You Spend

When you obtain your working capital financing through our merchant cash advance program, we do not regulate how you spend your money. Unlike a traditional bank loan for businesses, there are absolutely no restrictions on what you can do with the money. We can provide you with up to $150,000 right now – that’s working capital financing that works for you!

It is very simple to apply; there is minimal paperwork and fast approvals. Within just a few business days, you could have the working capital financing you need. We have very high approval rates, so do not be afraid to apply – even if you have been turned down by the bank.

No Fixed Payments Means No Stress

When you apply for working capital financing and obtain your money, you never have to worry about how or when you are going to make payments on your obligation. Since your cash advance is paid back in future credit card sales, we automatically receive the money as your business earns it back. Additionally, there is no fixed timeframe for when you have to pay the money back. If sales are slow, we will continue to deduct payments from future credit card sales as they come in. You never have to stress or lose sleep over when the working capital financing will be repaid. If you need money for your business, simply apply today. It only takes a few minutes. You’ll have an approval and the money you need in a few days.

Options For Medical Office Building Loans in Canada

If you're a doctor, you may be considering a medical office building loan. However, most doctors are surprised not only by how arduous the loan process is, but the length of time required for the loan to close. There are also many forces that can affect a doctor's...

The Canadian Small Business Financing Program

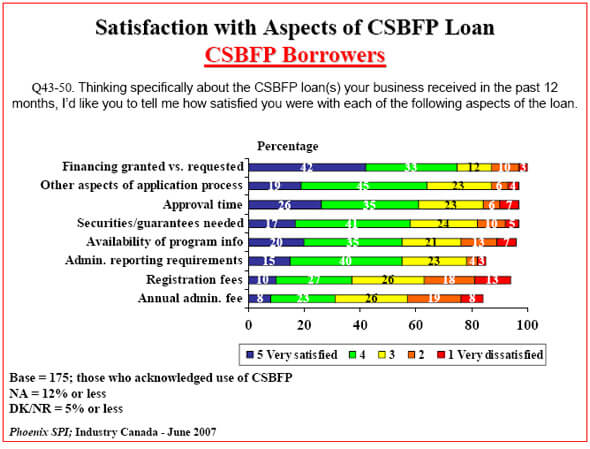

With all the variety of business loans available, small businesses in Canada have an ally in the form of the Canadian Small Business Financing (CSBF) Program. The CSBF was formed in 1999 to assist Canadian small businesses with obtaining a loan for capital...

7 Reasons Your Business May Not Qualify For a Loan in Canada

Did you recently receive a loan rejection letter? In today’s tight Canadian credit market, there are many reasons why your application may have been rejected, as lenders become stricter about their criteria. If you want to learn about why your loan application...

Are you currently accepting payments using credit or debit cards at your business? If so, we can probably help you find the money you need fast. Apply Now!