- Looking for working capital to help grow your business?

- Need some money to get you through tough times?

- Is the bank not giving you a loan due to bad credit scores?

- Does your business accept credit or debit cards for payments?

We can probably help you!

Unsecured Business Loan

If you think you want an unsecured business loan, you should consider this alternative product which is not actually even a loan: a Business Cash Advance. We are a Canadian owned and operated company backed by substantial assets, and we can help you get the unsecured business loan alternative you need for your company.

If you have already tried to obtain an unsecured business loan through a traditional bank but have been denied, we can still help. To get an unsecured business loan through a bank, there is a set of very strict criteria you must meet, and most of the time, it is next to impossible to be approved. Even if your business is doing well, it may still be difficult to get an approval for an unsecured business loan the traditional way. Do not let that stand in your way of getting up to $150,000 to use toward your necessary business expenses.

Turn Future Credit Card Sales Into An Approved Unsecured Business Loan Alternative

If you accept debit or credit cards for your business, through our merchant cash advance program, we can offer you cash of up to $150,000 based on your future credit card/debit sales. We are able to do this by purchasing a portion of your future credit card receivables and recouping your obligation as your business earns it through credit card sales. If your business accepts Visa or MasterCard as a form of payment, we work directly with your credit card processor and rely on your records of business to grant you the cash you need.

What Are The Benefits Of An Unsecured Business Loan Alternative From Business Cash Advance Canada?

Our unsecured business loan alternative in the form of a merchant cash advance is a popular choice for businesses because of all of the benefits we offer. First of all, the approval process is fast and easy with minimal paperwork. Second, there are no credit checks to undergo – so you can still be approved, even if your credit history is less than perfect.

Additionally, there are no fixed payments, no set timeframe to repay your obligation, and you can get up to $150,000 for your business in no time. Another benefit is that there are absolutely no restrictions on how you spend the money you get from your unsecured business loan. Whatever your business needs the money for, we are here to help. There is no need to disclose to our company how the funds will be used.

What Are The Terms Of Repayment?

With no fixed payment schedule and no set timeframe in which your unsecured business loan must be paid back, you are probably wondering how we will receive payment on your obligation. It is a very simple process, as we interact directly with your credit card processor to receive payments. Purchasing a portion of your credit card receivables allows us to take a fixed percentage of your future credit card sales as they come in. Your unsecured business loan alternative is simply paid back as your business earns it. If our unsecured business loan alternative sounds right for you, apply now through our online application form.

Options For Medical Office Building Loans in Canada

If you're a doctor, you may be considering a medical office building loan. However, most doctors are surprised not only by how arduous the loan process is, but the length of time required for the loan to close. There are also many forces that can affect a doctor's...

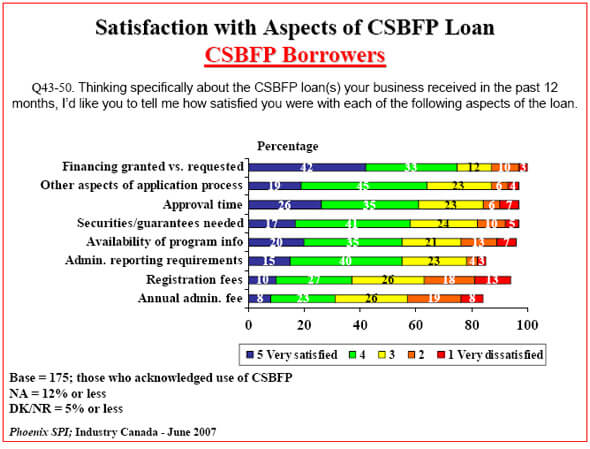

The Canadian Small Business Financing Program

With all the variety of business loans available, small businesses in Canada have an ally in the form of the Canadian Small Business Financing (CSBF) Program. The CSBF was formed in 1999 to assist Canadian small businesses with obtaining a loan for capital...

7 Reasons Your Business May Not Qualify For a Loan in Canada

Did you recently receive a loan rejection letter? In today’s tight Canadian credit market, there are many reasons why your application may have been rejected, as lenders become stricter about their criteria. If you want to learn about why your loan application...

Are you currently accepting payments using credit or debit cards at your business? If so, we can probably help you find the money you need fast. Apply Now!