- Looking for working capital to help grow your business?

- Need some money to get you through tough times?

- Is the bank not giving you a loan due to bad credit scores?

- Does your business accept credit or debit cards for payments?

We can probably help you!

Canadian Small Business Blog

How to Manage a Restaurant’s Finances

The cash flow that a restaurant has is something that might change...

Tips for Marketing Your Restaurant

One of the toughest parts of running a restaurant involves marketing...

Finding Funding For Buying/Renovating A Medical Office Building

If you're a doctor, you may be considering a medical office building...

What is Purchase Order Funding?

Purchase Order Funding can be a useful service to use for your short...

4 Options for Franchise Financing in Canada

Franchise Financing There are all sorts of independently owned...

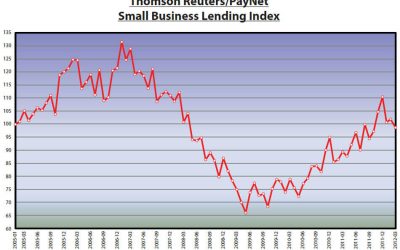

PayNet Study Shows Small Business Lending Fell in April

Banks are closing their doors to small business owners as they...

Finding Restaurant Financing and Capital in Canada

Restaurant Financing and Capital No restaurants are ever able to...

Options For Medical Office Building Loans in Canada

If you're a doctor, you may be considering a medical office building...

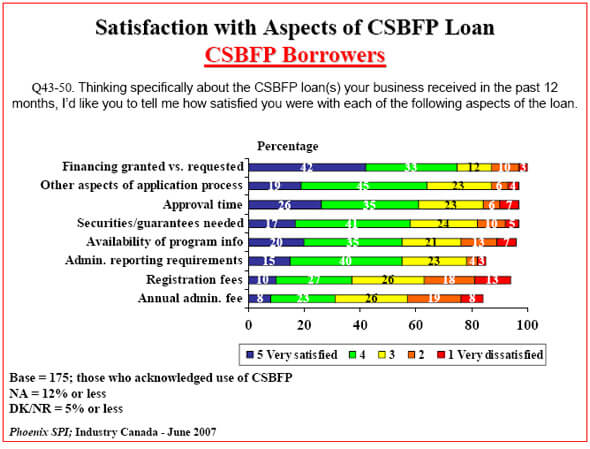

The Canadian Small Business Financing Program

With all the variety of business loans available, small businesses...

7 Reasons Your Business May Not Qualify For a Loan in Canada

Did you recently receive a loan rejection letter? In today’s...

Options For Medical Office Building Loans in Canada

If you're a doctor, you may be considering a medical office building loan. However, most doctors are surprised not only by how arduous the loan process is, but the length of time required for the loan to close. There are also many forces that can affect a doctor's...

The Canadian Small Business Financing Program

With all the variety of business loans available, small businesses in Canada have an ally in the form of the Canadian Small Business Financing (CSBF) Program. The CSBF was formed in 1999 to assist Canadian small businesses with obtaining a loan for capital...

7 Reasons Your Business May Not Qualify For a Loan in Canada

Did you recently receive a loan rejection letter? In today’s tight Canadian credit market, there are many reasons why your application may have been rejected, as lenders become stricter about their criteria. If you want to learn about why your loan application...

Are you currently accepting payments using credit or debit cards at your business? If so, we can probably help you find the money you need fast. Apply Now!