For entrepreneurs, managing cash flow is crucial for both running and growing their businesses. Traditional loans, however, may not always be the best option—especially when you need quick access to funds or don’t meet lending requirements. That’s where a merchant cash advance (MCA) comes in, offering flexible, fast funding without the hassle of traditional financing.

Business Cash Advance: Supporting Canadian Businesses with Customized Merchant Cash Advances

At Business Cash Advance, we are committed to providing customized financial solutions that cater to the unique needs of Canadian businesses. Our Merchant Cash Advance (MCA) options are specifically designed to empower businesses with quick and flexible access to capital.

What is a Merchant Cash Advance?

A Merchant Cash Advance (MCA) is a financing option different from traditional loans. Rather than borrowing a fixed amount with set repayment terms, an MCA provides businesses with a lump sum of cash upfront in exchange for a portion of their future credit card or debit card sales.

This type of funding is particularly well-suited for businesses with consistent card-based transactions, as repayments are automatically drawn from daily sales. The flexible repayment structure ensures businesses can manage payments in proportion to their revenue, making it an attractive solution for those seeking quick access to capital without the constraints of traditional loan agreements.

In general, the amount is paid back using a discounted amount from your sales, either daily or weekly, making it easier for businesses that face constant fluctuations in revenue.

Key Features of a Merchant Cash Advance:

- Fast Funding: Cash received can be delivered within a few days.

- Repayment Flexibility: The repayment amount adjusts based on your sales volume.

- No Fixed Monthly Payments: You do not repay a fixed amount per month but rather a fraction of your income.

- Credit-Friendly: Approval doesn’t depend on your credit score.

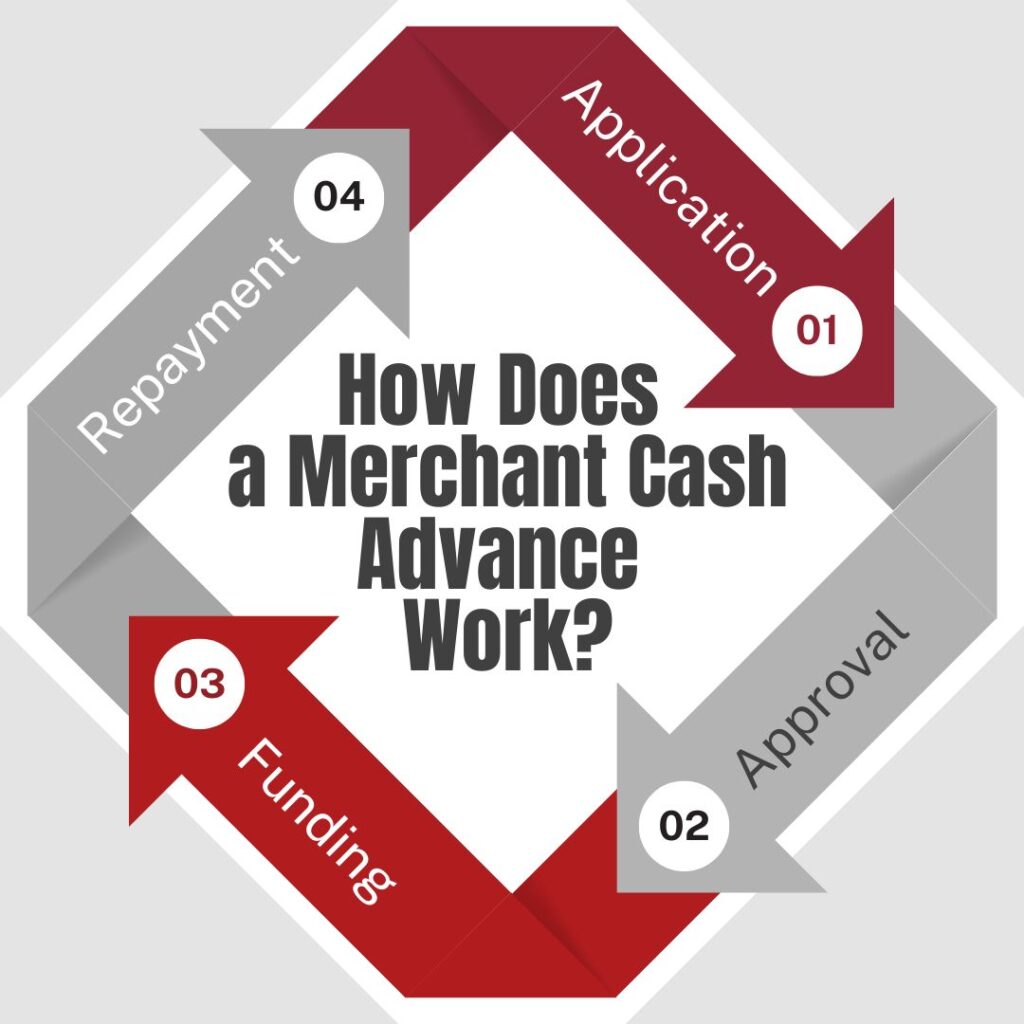

How Does a Merchant Cash Advance Work?

Securing a merchant cash advance is simple. Just follow these easy steps:

- Fill Out an Application: Provide basic information about your business, including sales history and monthly revenues.

- Wait for Approval: At Business Cash Advance, we will quickly review your application and approve it within 24 to 48 hours.

- Obtain Funding: Once approved, the agreed-upon amount will be deposited directly into your account.

- Begin Repayment: A set percentage of your future sales will be automatically deducted until the full advance is paid off. This percentage is known as the “holdback rate.”

For example, suppose you were approved for a $20,000 advance with a 10% holdback rate. That means $2,000 from every 20,000 dollars in sales will go toward repaying the advance.

Who Can Benefit from a Merchant Cash Advance?

Merchant cash advances can benefit many types of businesses, especially those that:

- Process a large volume of daily credit and/or debit card sales, such as retail stores, restaurants, or e-commerce shops

- Need immediate funds to cover operational costs, like purchasing inventory, marketing, or upgrading their equipment.

- Struggle to qualify for traditional loans due to a low credit score or limited financing history.

At Business Cash Advance, we’ve helped many Canadian entrepreneurs bridge financial gaps and seize valuable growth opportunities. Whether you’re a start-up or an established business, an MCA could be exactly what you need.

Advantages of a Merchant Cash Advance

Fast Access to Funds

While traditional loans can take weeks and even months to process, a merchant cash advance can give you money within a span of hours, making it an ideal solution to meet urgent business financing needs.

Flexible Repayment Structure

Another advantage of MCAs is their flexible repayment structure. Unlike traditional loans with fixed monthly payments, the repayment amount varies based on your sales. If your business experiences a slow month, the repayment will be lower.

Credit-Friendly Option

A merchant cash advance has become a viable option for businesses with less-than-perfect credit, as it focuses primarily on expected revenue rather than credit scores.

No Collateral Required

Merchant cash advances are unsecured, meaning assets don’t have to be pledged against poor credit, reducing the overall risk to your business.

Supports Business Growth

Quick access to funds allows you to seize investment opportunities, such as expanding your product line, upgrading equipment, or launching a marketing campaign, without losing valuable time.

Merchant Cash Advance for Start-Ups

Start-ups often face significant challenges in securing traditional financing due to their limited operational history and lack of established credit. For many start-ups, accessing capital through bank loans can be nearly impossible. In these situations, a merchant cash advance offers a viable and flexible alternative to traditional financing.

An MCA provides businesses with a lump sum of cash in exchange for a percentage of future credit card or daily sales. This funding model is particularly advantageous for start-ups that generate consistent sales from regular transactions. By leveraging projected revenue, businesses can secure the funds they need to address immediate operational needs, invest in growth, or manage cash flow effectively.

At Business Cash Advance, we specialize in working with start-ups to assess their future potential and tailor funding solutions to meet their unique needs. Our approach ensures that businesses receive the necessary financial support without the burden of rigid repayment schedules typically associated with traditional loans.

How to Choose the Best Merchant Cash Advance Provider

Choosing the right merchant cash advance provider is crucial to ensure your business secures the necessary funding under favorable terms. Here are some key factors to consider when evaluating MCA providers:

1. Reputation

A provider’s reputation reflects their credibility and reliability. Partner with a well-established and trusted provider like Business Cash Advance, known for transparent terms and a strong commitment to customer satisfaction. Research customer reviews, testimonials, and industry ratings to gauge the provider’s trustworthiness and track record.

2. Fees and Rates

Understanding the costs involved is essential to avoid unexpected financial burdens. Be sure to research the following:

- Factor Rates: This multiplier determines the total repayment amount, with lower factor rates being more favorable for your business.

- Holdback Percentage: This is the percentage of daily sales deducted for repayment. Ensure the percentage aligns with your cash flow to avoid operational strain.

It’s important to request a clear breakdown of all costs from an MCA provider, including any upfront fees or additional charges, to ensure full transparency.

3. Flexibility

A good MCA provider will offer repayment terms that align with your business’s unique sales patterns. Flexible repayment schedules, such as those based on a percentage of daily sales, ensure payments remain manageable during slower periods. Evaluate whether the provider offers tailored solutions that match your business’s revenue fluctuations.

4. Customer Support

Strong customer support is vital during the repayment process. Choose a provider that offers ongoing assistance and clear communication channels. This ensures you have access to help if any issues or questions arise, creating a smoother borrowing experience.

5. Industry Experience

Look for providers with expertise in your industry. An experienced MCA provider will better understand the challenges and opportunities specific to your business sector, allowing them to offer customized funding solutions.

6. Speed of Funding

One of the primary advantages of MCAs is the quick access to capital they provide. Assess the provider’s funding process and timelines to ensure they can deliver funds when your business needs them most.

7. Transparency

Avoid providers with vague or hidden terms. Ensure the agreement is straightforward, with clear explanations of repayment schedules, penalties, and other obligations. Transparent providers build trust and help you make informed decisions.

By considering these factors, you can confidently choose an MCA provider that meets your financial needs while fostering a long-term partnership that supports your business growth.

Common Questions About Merchant Cash Advance

Q: What is a merchant cash advance?

A merchant cash advance (MCA) is a financing option where a business receives a lump sum payment upfront in exchange for a percentage of its future sales. This is not a traditional loan but a cash advance repaid through daily or weekly deductions from sales revenue, making it a flexible solution for businesses with varying incomes.

Q: What does the term “cash advance” mean in business?

In business, the term “cash advance” refers to a financial arrangement where funds are provided upfront to meet immediate needs. This could involve borrowing against expected credit card sales, invoices, or future revenue. A merchant cash advance is a specific type of business cash advance designed for companies relying on regular card transactions.

Q: What is the legal term “MCA”?

The legal term “MCA” stands for merchant cash advance. It refers to a commercial financing agreement where a business agrees to sell a portion of its future sales at a discount in exchange for upfront capital. The repayment terms, rates, and other specifics are typically outlined in a legal contract between the business and the MCA provider.

Q: What is the difference between a merchant cash advance and a loan?

A merchant cash advance provides funding based on future sales, while a loan involves borrowing a set amount with fixed repayments. MCAs are more flexible and quicker to obtain than traditional loans.

Q: How much can I qualify for?

The amount you can qualify for depends on your monthly sales volume. At Business Cash Advance, we typically provide advances ranging from $5,000 to $500,000.

Q: Can I apply with bad credit?

Yes! MCAs focus on your revenue, not your credit score, making them a viable option for businesses with poor or no credit history.

Why Choose Business Cash Advance?

Business Cash Advance has dedicated financing resources to support Canadian entrepreneurs. Here’s why our businesses trust us:

- Quick Approvals: Receive payments within 24-48 hours.

- Transparent Terms: No hidden fees or surprises.

- Dedicated Support: Our team is here to guide you every step of the way.

- Flexible Solutions: Whether you’re a start-up or an established business, we’ll customize an advance to fit your needs.

Steps to Get a Merchant Cash Advance Today

- Visit our website, Business Cash Advance

- Complete the application and provide your business details and sales information.

- Our team will review your application and approve you within 24 hours.

- Access your funds quickly and start using them to grow your business.

Conclusion

Merchant cash advances are among the most flexible, speedy, and effective funding solutions for Canadian businesses in need of quick capital. Whether you’re balancing seasonal sales fluctuations or investing in growth, an MCA from Business Cash Advance offers a straightforward solution without the hassle of traditional loans.

Are you ready to take the next step? Visit Business Cash Advance today and find out how you can apply for a merchant cash advance that’s custom-tailored to your business needs. Give your business a boost with fast, reliable funding designed for Canadian entrepreneurs.