What Are Unsecured Business Loans and How Do They Work

Unsecured business loans are financial products designed for businesses that require funding without pledging any collateral. Unlike secured loans, which require assets like property or equipment as security, unsecured loans are granted based on the creditworthiness and financial health of the borrower.

How Unsecured Business Loans Work

- Application Process: Business owners provide personal and business financial information, such as income statements and credit scores.

- Approval Criteria: Lenders assess the borrower’s ability to repay the loan based on cash flow, credit history, and financial projections.

- Loan Disbursement: Once approved, the loan amount is disbursed, often within days, offering rapid access to funds.

- Repayment Terms: Repayment periods can range from a few months to several years, typically with fixed monthly installments or customized schedules.

Business Cash Advance Canada provides an alternative form of financing: business cash advances. These advances are based on future sales, offering flexibility and quick funding for businesses without needing collateral.

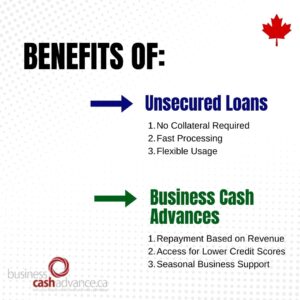

Benefits of Unsecured Loans and Business Cash Advances for Small Businesses

Unsecured business loans and business cash advances cater to the diverse needs of small businesses by offering unique benefits.

Advantages of Unsecured Business Loans

- No Collateral Required: Businesses retain full control of their assets.

- Fast Processing: Approval and disbursement processes are quick, making these loans ideal for urgent funding needs.

- Flexible Usage: Funds can be directed toward inventory, equipment, marketing, or other operational expenses.

Advantages of Business Cash Advances

- Repayment Based on Revenue: Repayment aligns with daily sales, easing the burden during slower periods.

- Access for Lower Credit Scores: Lenders focus more on business sales than credit scores.

- Seasonal Business Support: Ideal for businesses with fluctuating revenue, such as retail or hospitality.

Example: A bakery in Vancouver uses a business cash advance from Business Cash Advance Canada to purchase high-quality ingredients during peak holiday demand. Flexible repayment ensures the advance aligns with their seasonal income.

How to Qualify for Unsecured Loans and Business Cash Advances

Although unsecured loans and business cash advances share some similarities, their qualification requirements differ.

Eligibility for Unsecured Business Loans

- Good Credit Score: A score above 650 is typically preferred.

- Stable Revenue: Demonstrable income ensures repayment capability.

- Established Business History: Lenders often require at least one year of operations.

Eligibility for Business Cash Advances

- Consistent Card Sales: Regular credit or debit card transactions are essential.

- Business Performance: Revenue stability takes precedence over credit history.

- Short-Term Needs: Best suited for businesses looking for flexible and fast funding options.

List of Top Lenders Offering Unsecured Loans and Business Cash Advances in Canada

1. OnDeck Canada

- Products Offered: Unsecured loans, business cash advances

- Loan Amount: Up to $300,000

- Features: Quick approvals, flexible repayment terms

2. Business Cash Advance Canada

- Products Offered: Business cash advances

- Loan Amount: Flexible, based on sales volume

- Features: Specializes in fast funding for small businesses with tailored repayment plans.

Why Choose Business Cash Advance Canada?

Headquartered in Toronto, Ontario, this lender is a member of the Canadian Association for Merchant Processors. Their mission is to simplify funding by providing comprehensive solutions for businesses needing additional capital to grow or cover operating expenses.

3. Thinking Capital

- Products Offered: Business cash advances

- Loan Amount: $5,000 to $300,000

- Features: Tailored for businesses with strong card sales

4. Sharp Shooter Funding

- Products Offered: Unsecured loans

- Loan Amount: Up to $250,000

- Features: Ideal for startups and growing businesses

5. Clear.co

- Products Offered: Revenue-based financing (similar to business cash advances)

- Loan Amount: Based on revenue projections

- Features: Excellent for e-commerce and SaaS businesses

Conclusion

Unsecured business loans and business cash advances are excellent financial solutions for small businesses in Canada. Whether you prefer a fixed repayment schedule or the flexibility of repayments based on daily sales, options like Business Cash Advance Canada empower businesses to grow and thrive. Evaluate your needs, choose a reliable lender, and take the next step toward achieving your business goals.

Frequently Asked Questions About Unsecured Business Loans and Business Cash Advances

What is the difference between a business cash advance and an unsecured business loan?

Unsecured loans involve fixed monthly payments, while business cash advances are repaid based on daily sales, offering flexibility during slow periods.

Can startups qualify for unsecured loans or business cash advances?

Yes. Startups can qualify, especially for business cash advances if they demonstrate consistent card sales.

What makes Business Cash Advance Canada stand out as a lender?

Business Cash Advance Canada offers fast, flexible funding designed specifically for small businesses, with repayment terms that align with daily sales.

Are interest rates higher for unsecured loans compared to secured loans?

Yes, unsecured loans generally have higher rates due to the lack of collateral, but business cash advances may also include additional fees for flexibility.

How fast can I receive funds from Business Cash Advance Canada?

Funds are typically disbursed within 24 to 72 hours after approval, making it one of the fastest options in Canada.

Is collateral required for either option?

No, neither unsecured loans nor business cash advances require collateral, making them accessible to businesses without substantial assets.