Introduction

If you’re an entrepreneur in Canada, securing funding for your business can make all the difference in your journey. Fortunately, Canadian government grants provide a wide array of options for small businesses, startups, and minority-owned ventures. Business grants can give you access to non-repayable financial assistance — a valuable alternative to loans, which often carry heavy financial burdens.

In this comprehensive guide, we’ll explore:

- How to apply for business grants in Canada

- The best government grants for small businesses

- Differences between grants and loans

- Options available for startups and minority-owned businesses

By the end, you’ll understand how to leverage business grants in Canada to fuel your venture.

What Are Business Grants in Canada?

Business grants in Canada are forms of financial assistance provided by federal, provincial, and territorial governments, as well as some private organizations. These grants are often non-repayable, meaning recipients do not need to pay back the funds, unlike loans or advances. Grants can cover various costs, from startup expenses and marketing to research and development and employee training.

Government grants target specific needs and industries, such as tech innovation, sustainability projects, and Indigenous businesses. Many are designed to foster economic growth and support the entrepreneurial ecosystem in Canada.

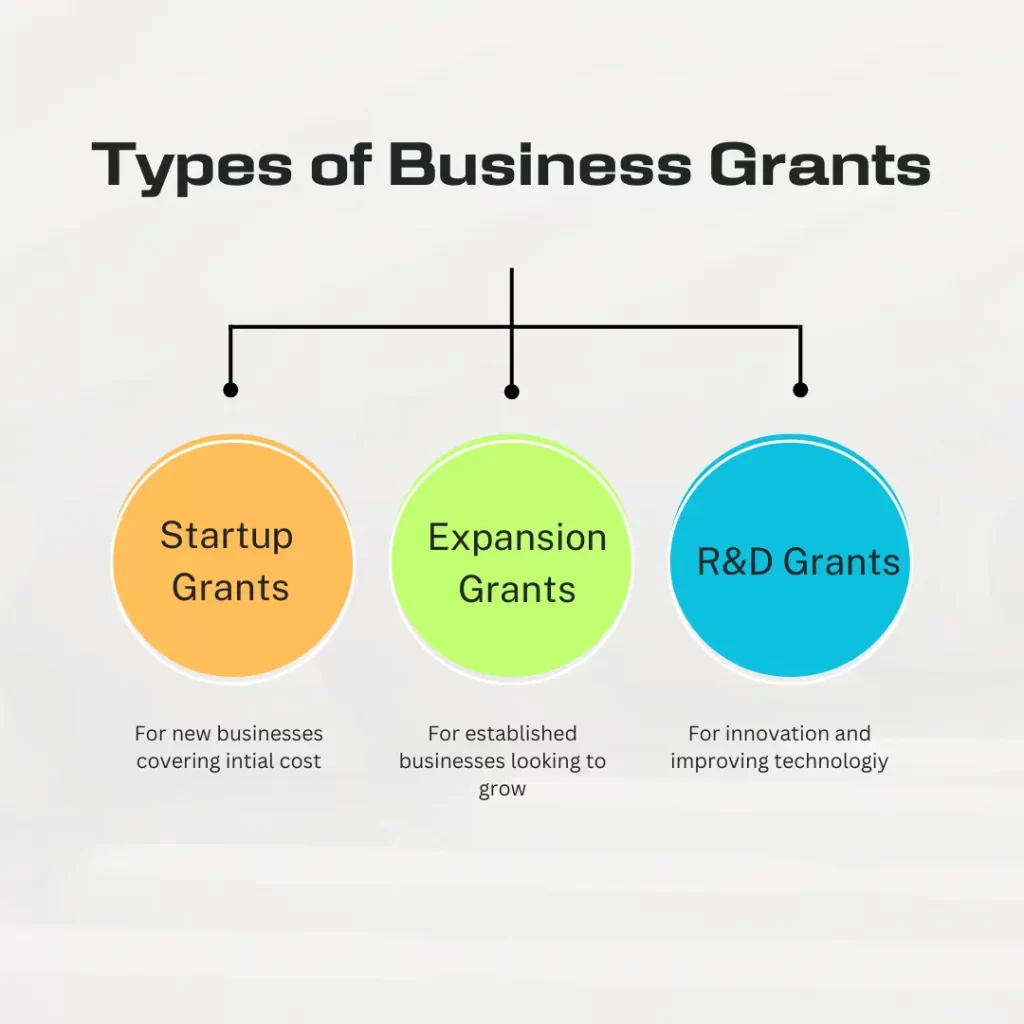

Types of Business Grants in Canada

Canadian business grants fall into three main categories, each serving different purposes:

Startup Grants

These are intended for new businesses to cover initial costs, such as purchasing equipment, hiring staff, and other setup expenses. Startup Canada offers various grants and funding opportunities for emerging businesses to help them gain traction early on.

Expansion Grants

For established businesses looking to grow, expansion grants help with marketing efforts, product expansion, and moving into new markets. These are especially useful for small and medium enterprises (SMEs) that need an additional boost to scale their operations.

Research and Development (R&D) Grants

Canada supports innovation through R&D grants for projects that advance technology and improve existing processes. Programs like IRAP (Industrial Research Assistance Program) help businesses involved in science and tech innovation by providing funding for product development and market research.

How to Apply for Business Grants in Canada

Applying for business grants in Canada requires preparation, organization, and attention to detail. Here’s a step-by-step approach:

- Identify Relevant Grants

Start by researching which grants are available and suitable for your business. Check federal, provincial, and industry-specific grant portals. - Prepare a Business Plan

A well-crafted business plan is essential. It should outline your business’s objectives, the target market, growth strategies, and how the grant funds will be used. Government agencies often look for clear, viable plans before approving funding. - Gather Required Documentation

Each grant has specific requirements for documentation. Common documents include tax records, proof of business registration, financial statements, and letters of recommendation. - Submit Your Application

Carefully follow the application instructions for each grant. Double-check for completeness and compliance with all guidelines, as incomplete applications are often rejected. - Follow Up

After submission, follow up with the grant office to confirm receipt and check on the status of your application. Persistence can sometimes lead to valuable feedback for future applications.

Top Government Business Grants for Small Businesses

1. Canada Small Business Financing Program (CSBFP)

The CSBFP is designed to support small businesses with access to capital through government-backed loans. The program aims to help businesses purchase land, equipment, and machinery needed for expansion. Note that this program operates through financial institutions across Canada.

2. Scientific Research and Experimental Development (SR&ED) Program

This tax incentive program assists businesses in the research and development sector by providing financial support to cover labour, materials, and equipment costs associated with R&D activities. The SR&ED program is highly beneficial for technology-based startups and innovative enterprises.

3. Regional Economic Growth through Innovation Program (REGI)

The REGI program provides funding to businesses that drive regional economic growth. It targets industries like manufacturing, clean technology, and tourism. Small and medium businesses that contribute to their local economy can benefit from REGI’s grants.

4. Canadian Agricultural Partnership (CAP)

For agricultural businesses, the CAP program offers funding to support innovation and growth in the agriculture and agri-food sector. Eligible businesses can receive support for projects that enhance productivity, improve sustainability, and promote market development.

To learn more about these programs and how to apply, visit the official website of Canada Government.

Business Grants vs. Business Loans in Canada

Business grants and loans are two distinct forms of financial assistance. Here’s a breakdown of their key differences:

- Repayment

Grants do not require repayment, making them ideal for small businesses looking to avoid debt. Loans, however, must be repaid with interest. - Eligibility Requirements

Grants often have specific eligibility criteria based on industry, location, or business type. Loans, on the other hand, are based primarily on creditworthiness and financial stability. - Funding Amounts

Grants may offer smaller amounts than loans. Loans can provide larger sums but come with the obligation to repay. Grants are usually targeted, covering only eligible expenses such as equipment or R&D. - Application Process

Applying for grants can be highly competitive and requires a detailed proposal. Loans generally require financial documentation, and lenders evaluate the business’s ability to repay.

Choosing between a grant and a loan depends on your business needs, financial situation, and long-term goals.

Best Business Grants for Startups in Canada

If you’re launching a startup, the following grants can help you get off the ground:

1. Futurpreneur Canada Startup Program

Futurpreneur Canada provides loans and mentorship to young entrepreneurs aged 18–39. The program combines financial support with expert guidance to assist startups in navigating the early stages.

2. Mitacs Accelerate Program

The Mitacs Accelerate Program provides R&D funding by pairing businesses with graduate students for research projects. This can be a valuable resource for tech startups that need specialized talent but have limited resources.

3. Canada Job Grant

This grant supports employee training, making it ideal for startups looking to skill up their workforce. Employers receive support to offset training costs, making it easier for startups to invest in their team’s capabilities

Government Grants for Minority-Owned Businesses in Canada

Minority-owned businesses are an essential part of Canada’s economy. Here are some grant options specifically for these entrepreneurs:

1. Aboriginal Entrepreneurship Program (AEP)

The AEP supports Indigenous entrepreneurs by providing access to capital and business opportunities. It funds eligible projects that foster economic growth and job creation within Indigenous communities

2. Black Entrepreneurship Program

The Black Entrepreneurship Program offers support for Black-owned businesses in Canada. Launched in partnership with Black-led organizations, this program provides financial resources, business training, and mentorship to support growth and competitiveness

3. Women Entrepreneurship Fund (WEF)

This program provides direct support to women-led businesses. It funds projects that improve market access, scalability, and innovation within women-owned businesses in Canada.

Tips for Success: How to Improve Your Grant Application

- Tailor Your Application to Each Grant

Avoid a one-size-fits-all approach. Customize each application according to the requirements and focus areas of each grant. - Demonstrate Your Business’s Impact

Grant programs want to support businesses that create jobs, foster innovation, and contribute to the economy. Clearly outline how your business benefits the community and economy. - Build Relationships with Grant Officers

Networking can help you understand the nuances of each program. Grant officers may offer tips on crafting a stronger application or suggest programs more suited to your business needs. - Highlight Your Financial Responsibility

Showcase your business’s financial management skills. Demonstrating a clear plan for utilizing funds effectively can boost your application’s credibility.

Conclusion

Navigating the world of business grants in Canada can be overwhelming, yet the potential rewards are well worth the effort. Grants provide crucial funding for small businesses, startups, and minority-owned ventures, allowing you to grow without the burden of loans. By understanding the types of grants available, preparing a tailored application, and highlighting your business’s unique value, you position yourself for success.

With the support of business grants, your journey as an entrepreneur can be propelled forward. Remember that each application is a step closer to your goals, so remain persistent and explore all opportunities that Canadian grants provide. Armed with the right information and a solid application, you can secure the funding your business needs to thrive. Good luck!

FAQs: Common Questions About Business Grants in Canada

Q. What are the main eligibility criteria for business grants in Canada?

Eligibility requirements vary by grant. Most programs evaluate factors such as business size, location, industry, and impact potential. Applicants may also need to meet specific demographic criteria, such as being a minority-owned business or a startup.

Q. Are business grants taxable in Canada?

In general, most business grants in Canada are considered taxable income. However, there are some exemptions depending on the nature of the grant and the program. It’s essential to consult a tax professional for accurate information on your specific grant.

Q. How often can I apply for grants?

You can apply for multiple grants simultaneously, but each grant has its deadlines and application frequency. Some are available year-round, while others operate on a seasonal basis. Check individual grant requirements for details on reapplying or applying for additional funding.

Q. Can I apply for both grants and loans?

Yes, businesses can apply for both grants and loans to maximize their funding. Grants do not affect your eligibility for loans, and securing a loan may even strengthen your financial profile for future grant applications.

Q. What are the chances of getting a business grant in Canada?

Due to high competition, business grants can be challenging to secure. However, following best practices, tailoring applications, and staying informed about new funding opportunities can improve your chances significantly.