Business Loans vs. Business Cash Advances: Which is Right for You?

Financing plays a crucial role in helping businesses grow, overcoming operational challenges, and navigating cash flow shortages. With many funding options available, choosing the right one for your business requires understanding the nuances of each option. Two popular choices are business loans and business cash advances (BCAs). While they serve similar purposes, their mechanisms, costs, and repayment structures differ significantly.

In this article, we’ll delve into the pros and cons of both options, explore their eligibility criteria, repayment terms, and use cases, and provide insights to help you decide which option best suits your business.

Understanding Business Loans

A business loan is a financial agreement where a lender provides a lump sum of money to a borrower, who agrees to repay it over time with interest. These loans are often structured with fixed repayment schedules and offer predictability, making them a go-to option for many businesses.

Types of Business Loans

- Term Loans: Provide a fixed sum repaid over a specified term with consistent monthly installments.

- Equipment Loans: Tailored for purchasing machinery or equipment, with the asset serving as collateral.

- Lines of Credit: Flexible funding that allows businesses to withdraw money as needed, up to a credit limit.

Advantages of Business Loans

- Lower Interest Rates: Compared to alternatives like cash advances, business loans often come with lower annual percentage rates (APRs).

- Predictable Repayment Schedule: Fixed monthly payments allow businesses to plan their finances effectively.

- Higher Loan Amounts: Lenders may approve larger sums for businesses with good credit and established track records.

- Longer Repayment Terms: Businesses benefit from extended repayment periods, often ranging from 1 to 25 years.

Disadvantages of Business Loans

- Lengthy Application Process: Securing a loan often involves extensive documentation and approval time, which can take weeks or months.

- Strict Eligibility Requirements: Strong credit scores, solid business history, and collateral are often mandatory.

- Risk of Collateral Loss: For secured loans, failing to repay could result in losing valuable assets.

Understanding Business Cash Advances

Business cash advances are short-term funding solutions where a provider offers an upfront lump sum in exchange for a percentage of future sales. Unlike loans, BCAs don’t have fixed repayment schedules, as payments are directly tied to revenue performance.

How Business Cash Advances Work

When a business opts for a cash advance, the provider evaluates the company’s historical sales (often credit card receipts) to determine the advance amount. Repayment occurs automatically, typically as a percentage of daily or weekly sales, until the advance is fully repaid.

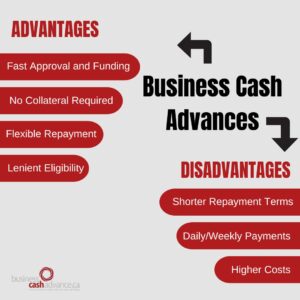

Advantages of Business Cash Advances

- Fast Approval and Funding: Funds are often disbursed within 24–48 hours of application.

- No Collateral Required: BCAs are unsecured, eliminating the risk of asset loss.

- Flexible Repayment: Payments fluctuate with revenue, making BCAs ideal for businesses with irregular income.

- Lenient Eligibility: Credit score requirements are minimal, with sales performance being the primary criterion.

Disadvantages of Business Cash Advances

- Higher Costs: Factor rates (1.2–1.5) result in higher overall costs compared to traditional loans.

- Shorter Repayment Terms: Repayment periods are typically shorter, often lasting only a few months.

- Daily or Weekly Payments: Frequent deductions can strain cash flow, especially during slow periods.

Eligibility Criteria: Loans vs. Cash Advances

Your ability to qualify for a business loan or cash advance depends on several factors. Here’s a side-by-side comparison:

| Criteria | Business Loans | Business Cash Advances |

| Credit Score | Good to excellent credit is often required. | Flexible; sales revenue takes precedence. |

| Time in Business | Minimum 1–2 years for most loans. | Can be as short as a few months. |

| Revenue Requirements | Stable and consistent revenue needed. | Demonstrated sales activity is key. |

| Documentation | Extensive (tax returns, business plans). | Minimal (bank or sales statements). |

| Collateral | Often required for secured loans. | No collateral required. |

Repayment Terms and Structures

Business Loans

- Fixed Repayments: Monthly payments remain consistent, making cash flow planning predictable.

- Longer Terms: Loan durations can span several years, reducing the monthly burden.

- Early Repayment: Some loans offer discounts for early payoffs, while others impose penalties.

Business Cash Advances

- Revenue-Based Repayments: Payments are a fixed percentage of daily or weekly revenue.

- Short Terms: Most advances are repaid within 6–12 months.

- No Fixed Deadlines: Repayment amounts vary with income, offering flexibility during slower periods.

Cost of Financing

The costs associated with business loans and cash advances differ significantly due to their structure.

Business Loans

Loans often have lower interest rates, typically ranging from 4% to 15%, depending on the borrower’s creditworthiness. The APR includes both interest and fees, giving a transparent view of the total cost.

Business Cash Advances

Cash advances use factor rates, typically ranging from 1.2 to 1.5. For instance, an advance of $50,000 with a factor rate of 1.3 means repaying $65,000. The effective APR can exceed 40%, making this option significantly costlier than loans.

Flexibility and Access to Funds

Cash advances are notably flexible, particularly for businesses with fluctuating incomes. Unlike loans, which require fixed monthly payments, BCAs adjust to sales performance. For example, if a restaurant experiences a slow season, its repayments automatically decrease.

However, loans offer stability. For businesses with steady revenues, fixed payments can help maintain consistent budgeting and financial forecasting.

Risk Assessment

Both options carry inherent risks.

- Business Loans: Defaulting on a loan can damage your credit score and, for secured loans, result in asset forfeiture.

- Business Cash Advances: Failing to generate sufficient sales could lead to a cycle of debt, as advances must be repaid regardless of profitability.

Impact on Credit Score

Business Loans

Timely repayment of a loan can enhance both your business and personal credit scores. Conversely, missed payments can negatively affect your creditworthiness.

Business Cash Advances

Since cash advances aren’t reported to credit bureaus, they have minimal direct impact on your credit score. However, failing to meet repayment obligations could lead to lawsuits or collection efforts, indirectly affecting your financial standing.

Use Cases for Business Loans

Business loans are best suited for:

- Expansions: Financing new locations or acquiring assets.

- Large Investments: Purchasing expensive equipment or technology.

- Long-Term Projects: Funding initiatives with longer timelines.

- Businesses with Strong Credit: Those able to secure low-interest rates.

Use Cases for Business Cash Advances

Cash advances are ideal for:

- Seasonal Businesses: Companies with fluctuating income, such as retail or tourism.

- Urgent Needs: Businesses needing immediate cash for emergencies.

- Low Credit Borrowers: Companies unable to secure traditional loans due to poor credit.

- Short-Term Gaps: Covering temporary cash flow shortages, such as payroll or inventory restocking.

Comparative Table

| Aspect | Business Loans | Business Cash Advances |

| Approval Time | Weeks to months. | 24–48 hours. |

| Repayment Schedule | Fixed monthly installments. | Percentage of revenue. |

| Cost | Lower interest rates. | Higher factor rates. |

| Flexibility | Limited. | Highly flexible. |

| Impact on Credit Score | Direct (reported to bureaus). | Indirect (not reported). |

| Risk | Default may result in asset loss. | High costs may lead to debt cycles. |

How to Choose the Right Option

Selecting between a loan and a cash advance depends on:

- Income Stability: If your revenue is steady, a loan offers predictability. For irregular income, a cash advance provides flexibility.

- Urgency: Need funds quickly? Opt for a cash advance.

- Cost Considerations: Loans are more affordable in the long term, but require good credit and time for approval.

- Repayment Preferences: Prefer fixed schedules? A loan is better. Need variable payments? Choose a cash advance.

Frequently Asked Questions

1. What is the primary difference between loans and cash advances?

Loans have fixed repayment schedules, while cash advances adjust payments based on sales performance.

2. Are cash advances more expensive than loans?

Yes, cash advances typically have higher effective costs due to factor rates.

3. Can I get a cash advance with bad credit?

Yes, cash advances prioritize sales revenue over credit scores.

4. Do cash advances require collateral?

No, cash advances are unsecured.

5. What happens if my income drops during a cash advance repayment period?

Payments decrease in proportion to revenue, offering flexibility.

6. Which is better for a startup: a loan or a cash advance?

Startups with strong sales but poor credit may find cash advances more accessible.

Conclusion

Both business loans and business cash advances serve vital roles in financing, but they cater to different needs. Loans offer stability, lower costs, and long-term benefits for established businesses with strong credit. On the other hand, cash advances provide speed, flexibility, and accessibility for businesses with fluctuating incomes or urgent needs.

Carefully assess your business’s financial health, goals, and repayment capacity before deciding. By choosing the right option, you can fuel your business’s growth while maintaining financial stability.