Equipment financing is a specialized loan designed to help businesses acquire necessary machinery, tools, or equipment without a significant upfront cost. Whether you’re launching a startup, upgrading existing equipment, or expanding operations, this type of financing ensures businesses can stay competitive without depleting their cash reserves.

How Equipment Financing Works

- Loan Purpose: Funds are specifically designated for purchasing or leasing equipment.

- Repayment Terms: Typically structured with fixed monthly payments over an agreed term.

- Ownership Options: Businesses can either own the equipment outright (financing) or use it temporarily (leasing).

- Collateral Requirements: Often, the equipment itself serves as collateral, reducing the need for additional assets.

Why Choose Equipment Financing?

- Preserve Cash Flow: Avoid large upfront payments, keeping cash for other operational needs.

- Tax Benefits: Depreciation and interest payments are often tax-deductible.

- Tailored Solutions: Flexible terms align with specific business needs and financial goals.

Comparison of Top Lenders Offering Equipment Financing in Canada

1. Business Cash Advance Canada

- Loan Amount: Flexible, depending on equipment value.

- Repayment Terms: Tailored repayment aligned with your business cash flow.

- Key Features:

- Headquartered in Toronto, Ontario, and committed to providing accessible financing solutions.

- Streamlined application process and fast approval.

- Offers additional business cash advance products.

2. RBC Royal Bank

- Loan Amount: Up to $1 million or more for large-scale equipment.

- Repayment Terms: Fixed and variable terms available.

- Key Features:

- Competitive interest rates for established businesses.

- Dedicated advisors for personalized guidance.

3. CWB National Leasing

- Loan Amount: Varies based on equipment type and value.

- Repayment Terms: Flexible leasing options from 1 to 7 years.

- Key Features:

- Specialized in agriculture, construction, and healthcare equipment.

- Option to upgrade or return equipment at the end of the lease term.

4. TD Equipment Financing

- Loan Amount: Scalable to meet large and small business needs.

- Repayment Terms: Fixed or customized schedules.

- Key Features:

- Comprehensive financial solutions for businesses of all sizes.

- Accessible to startups and established businesses.

5. Clear.co

- Loan Amount: Based on revenue projections.

- Repayment Terms: Flexible, aligned with business earnings.

- Key Features:

- Excellent for tech-driven businesses and startups.

- Revenue-sharing model eliminates fixed monthly payments.

Pros and Cons of Different Lenders

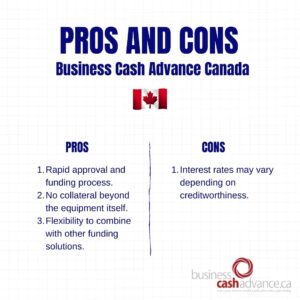

Business Cash Advance Canada

Pros:

- Rapid approval and funding process.

- No collateral beyond the equipment itself.

- Flexibility to combine with other funding solutions.

Cons: - Interest rates may vary depending on creditworthiness.

RBC Royal Bank

Pros:

- Competitive interest rates.

- Nationwide accessibility with strong customer support.

Cons: - Stringent eligibility requirements for startups.

CWB National Leasing

Pros:

- Industry-specific expertise in various sectors.

- Lease upgrade options.

Cons: - Limited funding for non-traditional equipment needs.

TD Equipment Financing

Pros:

- Flexible terms and repayment schedules.

- Suitable for businesses at any growth stage.

Cons: - Longer processing times for larger loan amounts.

Clear.co

Pros:

- Unique revenue-based repayment model.

- Excellent for e-commerce and digital-first companies.

Cons: - Not suitable for businesses with inconsistent revenue streams.

Tips for Securing the Best Financing Deal

1. Understand Your Needs

- Determine whether purchasing or leasing equipment aligns better with your financial strategy.

- Evaluate the equipment’s lifespan and potential return on investment (ROI).

2. Research Lenders

- Compare rates, terms, and conditions from multiple lenders.

- Check for hidden fees, such as prepayment penalties or application costs.

3. Strengthen Your Financial Profile

- Maintain a solid credit score to qualify for better rates.

- Prepare detailed financial statements to demonstrate repayment capability.

4. Negotiate Terms

- Don’t hesitate to discuss flexible repayment terms or interest rate reductions.

- Ask about bundled services, such as maintenance or insurance coverage.

5. Seek Expert Advice

- Consult financial advisors or accountants to understand the full impact of financing decisions.

- Choose a lender, like Business Cash Advance Canada, that offers tailored solutions for your unique business needs.

Conclusion

Finding the best equipment financing lender in Canada requires careful consideration of your business needs, financial goals, and the terms offered by various providers. With options like Business Cash Advance Canada, RBC Royal Bank, and Clear.co, businesses of all sizes can access flexible funding solutions to acquire essential equipment. Compare your options, negotiate the best terms, and choose a lender that supports your growth ambitions.