Introduction

In Canada’s fast-changing business world, getting enough funding is very important for success. Small businesses often face choices between business cash advances and traditional loans. This article is here to make these financial options easier to understand. It will clarify how they work and help you decide which one is the best fit for your needs.

Understanding Business Cash Advances

For businesses that need quick money, business cash advances are becoming a popular choice instead of regular bank loans. Let’s take a closer look at this financing option.

What Is a Business Cash Advance?

A business cash advance, also known as a merchant cash advance, gives companies a lump sum of cash upfront. In return, the business pays back a portion of its future credit card sales. Unlike traditional loans that have fixed monthly payments, the repayments for a business cash advance depend on the business’s income. This can be very useful for businesses that have changing cash flow.

In simple terms, the cash advance provider gives you a specific amount of money. You then agree to pay back that money plus a fee, which is shown as a factor rate. This factor rate shows how much borrowing costs, and it is different from the interest rate on a loan.

How Business Cash Advances Work in Canada

The way business cash advances work in Canada is closely connected to your credit card processing system.

- Factor Rate and Holdback Rate: When you get a business cash advance, you agree to a factor rate. At the same time, a holdback rate is set. This holdback rate is the part of your daily credit card sales that gets taken out to pay back the advance.

- Seamless Repayment: A great thing about a cash advance in Canada is how easy it is to repay. Your credit card processor takes the holdback rate directly from each credit card sale. This means you don’t have to worry about making manual payments.

- Monthly Credit Card Sales as a Determining Factor: Your monthly credit card sales matter when it comes to getting a business cash advance and figuring out how much you can borrow. Generally, the more sales you have, the more you can borrow.

Exploring Traditional Business Loans

Business cash advances are easy and quick. However, traditional business loans are still a key part of financing for businesses in Canada. Let’s look at the differences between them.

Types of Traditional Loans Available in Canada

The Canadian lending market has many traditional business loans suited for different needs:

- Standard Business Loans: Banks and other financial institutions offer these loans. They look closely at your credit and financial status. These loans usually have good interest rates but might need some form of collateral.

- Small Business Loans: These loans are made for small businesses. They often have support from the government, which can make it easier to borrow money.

- Business Lines of Credit: This is a flexible financing option. It allows you to access a set limit of credit. You can take out funds when you need them and pay back only what you use.

The Application Process for Traditional Loans

Traditional loans necessitate a more rigorous application process compared to business cash advances.

- Documentation and Creditworthiness: Be prepared to furnish a comprehensive set of documents, including your business plan, financial statements (typically covering the past two to three years), and proof of collateral. A strong credit history and credit score are crucial for approval.

- Longer Processing Times: Unlike the swift approval process of business cash advances, traditional loan applications can take several weeks or even months, as lenders conduct thorough due diligence.

- Collateral Requirements: Depending on the loan type and amount, collateral in the form of business assets or personal guarantees might be mandatory.

| Feature | Traditional Loan Application |

| Documents Required | Business plan, financial statements, credit history. |

| Processing Time | Several weeks to months |

| Credit Check | Yes, usually a hard inquiry |

| Collateral | Often required |

Comparing Advantages and Disadvantages

When thinking about which way to get money works best for you, it is important to look at the good and bad sides of both choices. Each has its own strengths and weaknesses. So, comparing them carefully is very important.

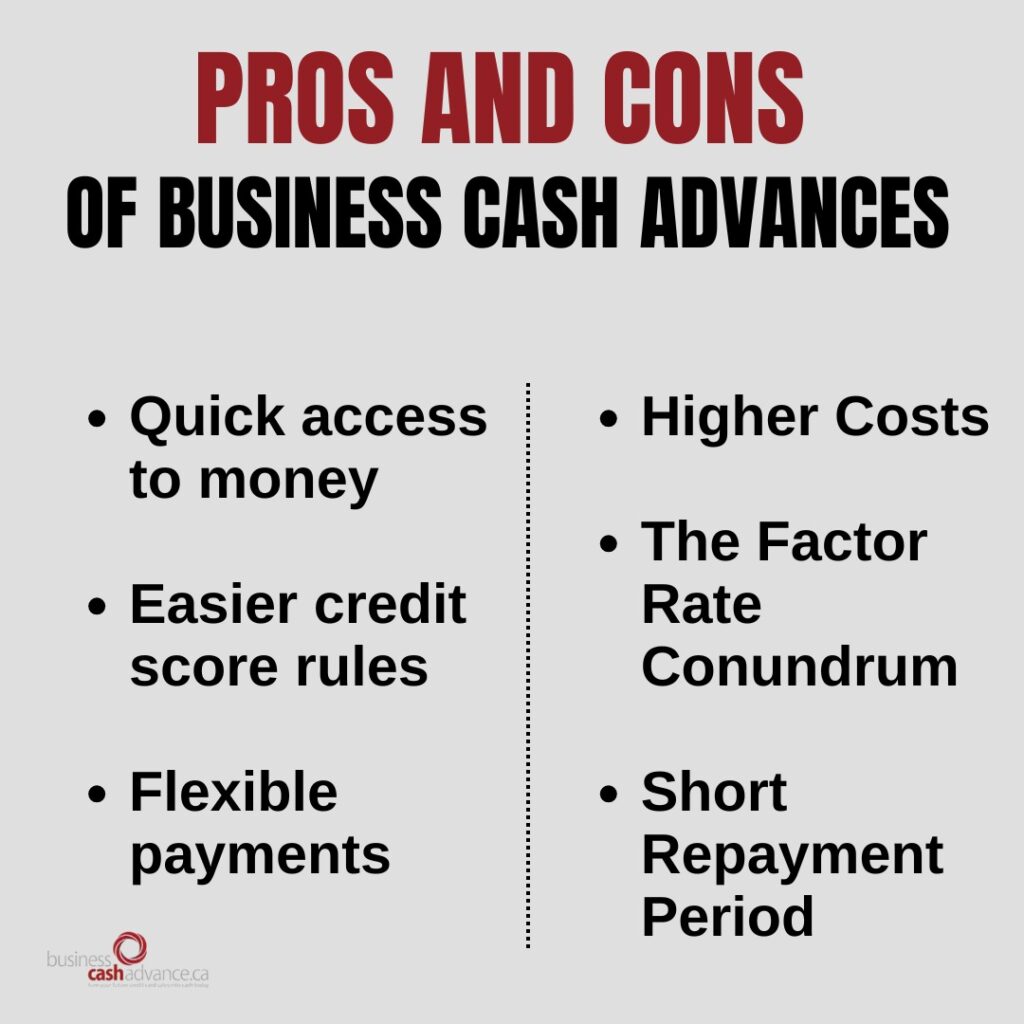

Pros of Business Cash Advances

Here’s why a business cash advance can be a good choice for your business:

- Quick Access to Money: Business cash advances give you money fast. You don’t have to wait long, like you do with traditional loans. You can usually get funds in just a few days. This is perfect for urgent needs.

- Easier Credit Score Rules: Business cash advances are often easier to get for new businesses and those with little credit history. The focus is on your sales, not just your credit score.

- Flexible Payments: The payment plan of business cash advances changes based on your cash flow. If your sales slow down, your payments will adjust. This helps lessen financial pressure.

Cons of Business Cash Advances

Business cash advances (BCAs) have some downsides you should know about:

- Higher Costs: Using a BCA is convenient and flexible, but it can cost more. The factor rates for BCAs are usually higher than the interest rates for traditional loans.

- The Factor Rate Conundrum: With BCAs, you cannot easily compare the factor rate to the interest rates of traditional loans. This can make it harder to see if you’re getting a good deal, which can lead to higher costs if you’re not careful.

- Short Repayment Period: BCAs usually require payments over a shorter time than traditional loans. While this helps you pay off your debt quickly, it also means you will have higher payments more often.

Benefits of Traditional Loans

Here’s why you might want to think about getting traditional loans for your business:

- Lower Interest Rates: Traditional loans usually have lower interest rates than the higher rates from BCAs. This can help you save money over time.

- Longer Repayment Period: These loans often let you pay back over several years. This means your monthly payments are smaller and easier to manage, which helps with your financial planning.

- Predictability for Financial Planning: With fixed interest rates and set monthly payments, traditional loans make it easier to plan your budget and predict your finances.

Drawbacks of Traditional Loans

Here are some downsides of traditional business loans:

- Stricter Credit Requirements: Traditional lenders have higher credit standards. This makes it hard for businesses with limited credit history or past credit issues to get approved.

- Lengthy Application Process: The process to apply for traditional loans can take a lot of time. It often needs a lot of paperwork and back-and-forth communication with lenders.

- Collateral is Frequently Needed: Many traditional loans need collateral to lower the lender’s risk. This means you may have to promise business assets or provide personal guarantees, which could put your personal assets in danger.

Conclusion

In conclusion, it’s important to know the differences between business cash advances and traditional loans. This knowledge helps you make the best financial choice for your business. Cash advances let you get money quickly and have fewer requirements. Traditional loans, on the other hand, give you more detailed financing options.

Think about your business needs, finances, and how you can repay the money before you choose one. Look at the good and bad sides of each choice to see which one fits your goals best. Getting advice from a professional can also help you make a smart decision based on your situation. Make the best choice to help your business grow and succeed.

Consult with a financial advisor to determine the best financing option for your business.

Frequently Asked Questions

What’s the main difference between a business cash advance and a traditional loan?

The main difference is how you pay it back. Business cash advances use a part of your future credit card sales to repay the amount. In contrast, traditional loans have set monthly payments. They usually require a stricter application process and a check of your credit score.

Can I qualify for a business cash advance with bad credit?

Qualifying for a business cash advance with bad credit is usually easier than getting a traditional loan. Business cash advances focus on future sales instead of credit score requirements. This means they can be a good option for people who do not have a great credit history.

How quickly can I access funds with a business cash advance compared to a traditional loan?

Funding speed is very important. Business cash advances usually provide money in just a few days. On the other hand, traditional bank loans can take weeks or even months to go through.

Are there restrictions on how I can use the funds from a business cash advance or traditional loan?

Both financing options let you use the money in flexible ways. You can usually spend the funds for different business needs. This includes buying inventory, improving equipment, or paying for operational costs.

What should Canadian businesses consider before choosing between a cash advance and a traditional loan?

Canadian businesses need to focus on their specific needs, how flexible repayment can be, and the cost of financing. This means looking at the factor rate for BCAs and comparing it to the interest rates for loans. Take a close look at your business’s finances. Check your cash flow projections and see how much risk you can handle.