- Looking for working capital to help grow your business?

- Need some money to get you through tough times?

- Is the bank not giving you a loan due to bad credit scores?

- Does your business accept credit or debit cards for payments?

We can probably help you!

How It Works

We offer a funding alternative to a bank loan

Instead of getting a loan, we will buy your future credit card receivables, at a reasonable discount and provide you with up to $150,000 cash today. We will then recoup your obligation by automatically taking a fixed-percentage of your sales from your credit card processor, as your business earns it. This means you will not be obligated to pay us directly, according to a fixed schedule, like you would probably be if you had a bank loan. Currently we offer funds in exchange for Visa and Mastercard receivables.

Advantages of a merchant cash advance over a loan

- No costs and very little time and effort required to apply. We do not need to pour over your financial records because we are not assessing your credit-worthiness like a bank does when it considers you for a loan.

- No fixed payment schedule to keep you up at night.

- Very fast approvals, we are usually able to turn around applications within a few business days.

- No credit check and very high approval rate.

- Speed – unlike loans we are able to get the cash to you fast so you can quickly take advantage of business growth opportunities.

- You can do whatever you want with the money – we do not concern ourselves with your money once we have given it to you.

Options For Medical Office Building Loans in Canada

If you're a doctor, you may be considering a medical office building loan. However, most doctors are surprised not only by how arduous the loan process is, but the length of time required for the loan to close. There are also many forces that can affect a doctor's...

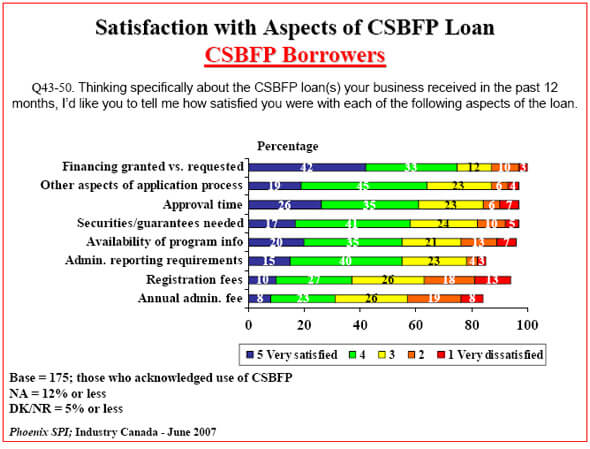

The Canadian Small Business Financing Program

With all the variety of business loans available, small businesses in Canada have an ally in the form of the Canadian Small Business Financing (CSBF) Program. The CSBF was formed in 1999 to assist Canadian small businesses with obtaining a loan for capital...

7 Reasons Your Business May Not Qualify For a Loan in Canada

Did you recently receive a loan rejection letter? In today’s tight Canadian credit market, there are many reasons why your application may have been rejected, as lenders become stricter about their criteria. If you want to learn about why your loan application...

Are you currently accepting payments using credit or debit cards at your business? If so, we can probably help you find the money you need fast. Apply Now!