- Looking for working capital to help grow your business?

- Need some money to get you through tough times?

- Is the bank not giving you a loan due to bad credit scores?

- Does your business accept credit or debit cards for payments?

We can probably help you!

Alberta Business Loans and Grants

If you run a small business in Alberta, you already understand the volume and type of capital that you need to keep your enterprise running smoothly. Whether you are starting a new endeavor in Alberta or would like to expand your current Alberta operations, there are numerous sources of loans and grants that you can use to finance your business.

Canadian Television Fund

The Canadian Television Fund is a government-industry partnership designed to improve the quality and quantity of Canadian programs. Its objective is to increase the quality of programming, improve the industry’s capability to produce and distribute programs, increase the presence of Canadian programs and films, and to create employment in the field. $200 million per year is available, and applicants can submit their request through either the license fee program or the equity investment program. The license fee program uses industry-oriented criteria to award money on a first-come, first served basis. The equity investment program selects projects that bring out the best of their genre.

You can apply for this program here.

Servus Credit Union Micro Loan

This loan program was designed for certain business people in Alberta. To qualify, you must be a member in good standing of Servus Credit Union or referred to the company by the Western Economic Diversification Canada. You must be willing to operate in the Edmonton Area and act as a mentor to other borrowers. Interested applicants must show commitment to their Alberta business through a significant time commitment and financial stake. Loans can be used to improve products, develop new products, marketing, equipment purchases, and working capital. They can be in amounts up to $25,000 and must be repaid within five years. Security and loan approvals are at the discretion of Servus Credit Union, and loans are set at prime rate interest rates and may have an additional risk premium.

For more information, call: 1-877-378-8728

Disabled Entrepreneur Investment Fund

This fund is designed to give loans to those with disabilities who are looking to start their own Alberta business by improving their access to capital gain. Loans can be up to $150,000 if you qualify.

You can apply for this program here.

Export Guarantee Program

This program provides a guarantee to the lender, allowing businesses to access additional financing. This program is for Alberta companies in export-related activities and foreign investments. It will guarantee loans to finance current jobs, establish working capital, purchase equipment, make business investments, finance inventory, and more. Coverage varies and can be anywhere from 75% – 100% and up to $10 million, depending on the size of the loan. To qualify for this Alberta loan program, you must be a Canadian company in the exporting and foreign investment business and have a lender that is willing to establish credit.

You can apply for this program here.

Industrial Associates

This program is designed to assist with research personnel needs by helping to recruit recent graduates to research programs. Its objective is to increase the research expertise, while also giving graduates research experience and a chance to contribute to the company. The Alberta Ingenuity Industrial Associateship can be held for two years and gives an annual $48,000 stipend and a research allowance of up to $7,000. As many as 40 grants will be given each year, with application deadlines held six times a year.

You can apply for this program here.

Industry Research Program

This Alberta program is open to anyone that is conducting research related to the AERI mandate. The industry research program helps to provide funding for different projects, including research and technology commercialization. The projects must have technical merit and fit into one of the AERI’s priority areas.

You can apply for this program here.

Innovations Assistance Program

This is an Alberta grant that helps to support inventions that will contribute to the energy industry that are in their early stages. The program was designed to help small inventors create and test new ideas before they are brought to the marketplace. Grants are available in amounts from $5,000 to $50,000.

You can apply for this program here.

Loan Investment Fund

This fund is for Alberta’s small businesses and provides them loans for startup costs and expansion projects. Loans can be in amounts up to $150,000 and offer fixed terms for up to five years, along with assistance and counseling, as well as competitive interest rates for repayment.

You can apply for this program here.

Security Compliance Loan

This loan allows Alberta businesses to upgrade their security to meet the U.S. border security requirements. Making these upgrades will allow for shorter border clearance times. The loan can be for up to $150,000 and can cover as much as 85% of the cost of the upgrades, with $5000 of that being used for a security gap analysis. Most loans are repayable over a term of three years. To qualify, you must be a Canadian business that has operated for at least three years. You must also agree to work with an approved advisory service and have a security gap analysis performed.

You can apply for this program here.

Targeted Wage Subsidy Program

This program is a non-repayable grant given to employers who will hire HRSDC clients. The employer is given up to 60% of the hourly wage rate for a term of 78 weeks. With this program, the Alberta employer pays the wages first and then receives a monthly reimbursement check.

You can apply for this program here.

Urban Entrepreneurs with Disabilities Initiative

This initiative assists disabled people in the Edmonton and Calgary areas who wish to pursue self-employment. To be eligible, the applicant must live in either Edmonton or Calgary and have a disability. The initiative provides loans ups to the amount of $75,000, which can be used for starting and expanding a business, purchasing new technology, upgrading the business, marketing, and working capital.

In Edmonton, contact:

Distinctive Employment Counseling Services of Alberta

11713-82 Street

Edmonton, Alberta T5B 2V9

Phone: 780-471-9604

In Calgary, contact:

Momentum

Room 16

2936 Radcliffe Drive South East

Calgary, Alberta T2A 6M8

Phone: 403-253-4646

The Value Added Technology Transfer Program

This Alberta program is designed to fund projects in the agri-food industry. Projects are funded on a 50-50 basis and the maximum amount of the financing is $25,000. To be eligible a project must be of a product new to the field or an improvement, has practical application and feasibility, or can modify technology and products used elsewhere to Alberta’s needs. Priority is given to small and medium Alberta businesses.

You can apply for this program here.

It doesn’t matter what you are looking for, we can help you find:

Calgary Business Loans, Edmonton Business Loans, Red Deer Business Loans, Lethbridge Business Loans, Medicine Hat Business Loans, Fort McMurray Business Loans.

Options For Medical Office Building Loans in Canada

If you're a doctor, you may be considering a medical office building loan. However, most doctors are surprised not only by how arduous the loan process is, but the length of time required for the loan to close. There are also many forces that can affect a doctor's...

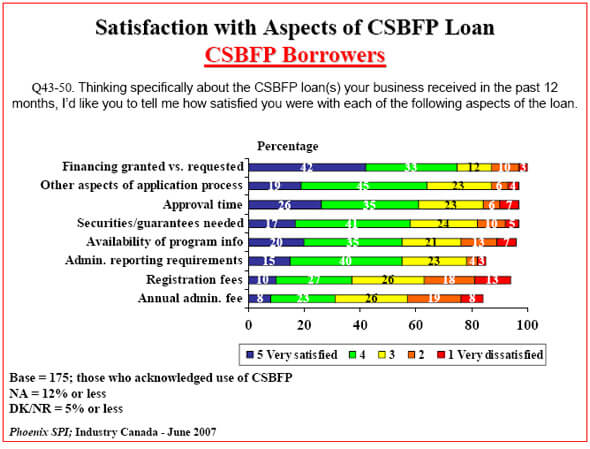

The Canadian Small Business Financing Program

With all the variety of business loans available, small businesses in Canada have an ally in the form of the Canadian Small Business Financing (CSBF) Program. The CSBF was formed in 1999 to assist Canadian small businesses with obtaining a loan for capital...

7 Reasons Your Business May Not Qualify For a Loan in Canada

Did you recently receive a loan rejection letter? In today’s tight Canadian credit market, there are many reasons why your application may have been rejected, as lenders become stricter about their criteria. If you want to learn about why your loan application...

Are you currently accepting payments using credit or debit cards at your business? If so, we can probably help you find the money you need fast. Apply Now!